Property Law

Whether buying, selling, leasing, subdividing, building or renting, our experienced team of property specialists will help you get the most out of your property investment.

Holland Beckett offers comprehensive property law and conveyancing advice to clients, from first home buyers to developers, to farm and orchard owners, to commercial property and retail investors.

Our specialist property teams will help you to navigate increasingly complex regulatory requirements, working closely with the environment and planning team when required to provide a complete solution to any real estate challenge.

Our Experience Includes:

- Sale and purchase agreements

- Residential tenancies

- Building contracts

- Unit titles and cross leases

- Bank lending and mortgages

- Residential subdivision and section purchases

- Buying and selling of commercial and industrial land

- Commercial lease drafting and negotiation

- Sub-leases

- Rent review disputes and mediation

- Overseas Investment Office consent applications

- Commercial and industrial subdivisions

Our Property Law Team

Related News & Resources

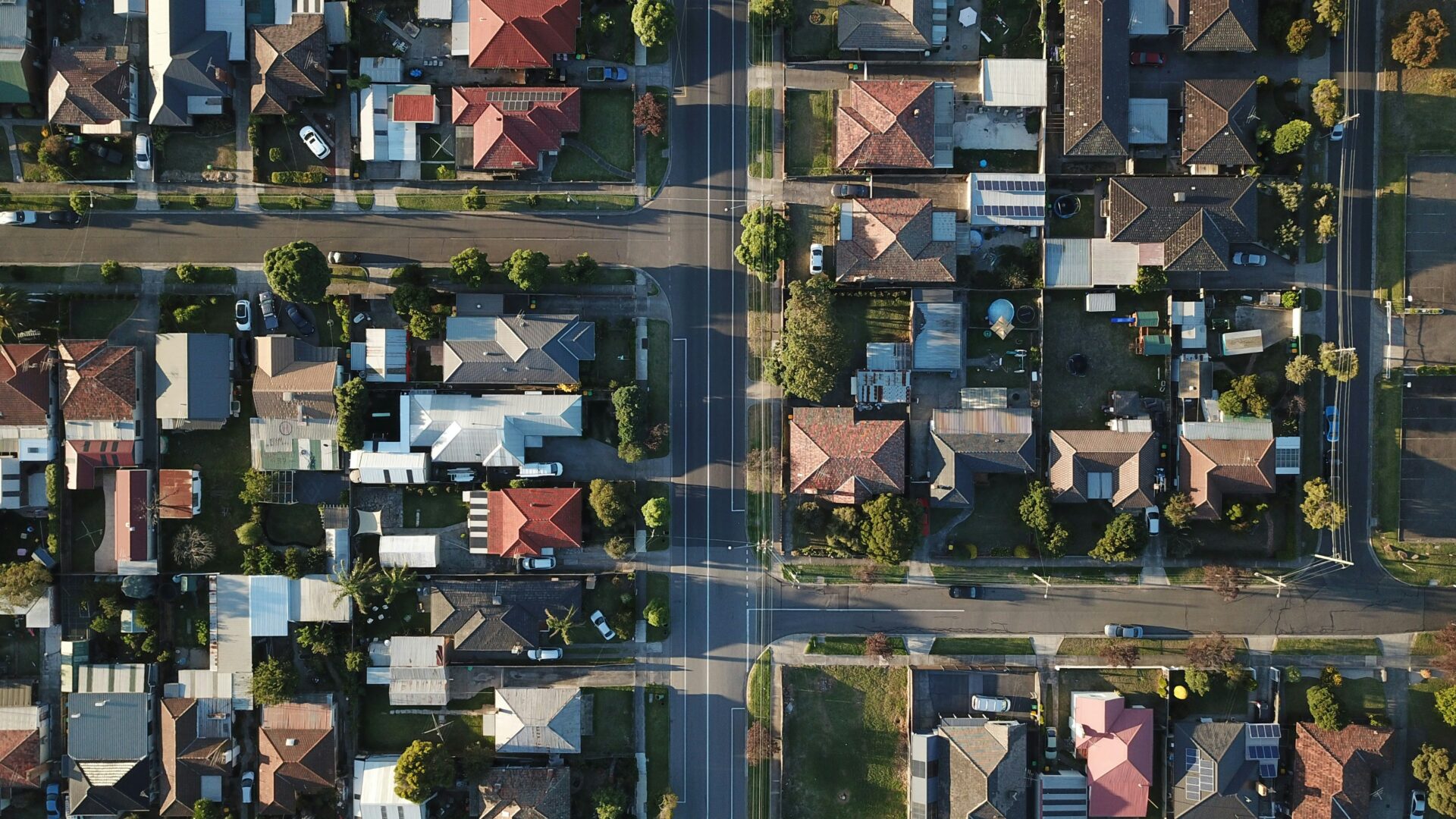

Room to Grow – The Future Is Infill

As New Zealand’s towns and cities grow and land becomes scarce, infill housing is an obvious solution to meet demand. Infill development encourages vibrant and inclusive communities by offering a range of housing choices, like duplexes, townhouses or apartments, close to existing amenities and public transport. It makes use of established infrastructure, helping to maintain and upgrade facilities, strengthening the neighbourhoods already in place.

However, thoughtful design is key. New developments need to respect the look and feel of the area, be well connected and include private and shared outdoor spaces. Safety and privacy can be provided with smart layouts, noise control and good lighting. The consenting processes across the country all emphasise these principles, and planning rules are increasingly focused on ensuring new homes contribute positively to the surrounding environment.

Ownership structure also matters when planning an infill project. There is often a strong preference for freehold titles because they provide a high degree of control and work well for standalone homes with private yards and driveways. Unit titles (or strata ownership) are commonly used for higher-density developments with shared spaces. However, either option can be made to work well in an infill context - it depends on the site, the design and the target market.

Beyond design and ownership, the long-term success and value of infill housing developments often comes down to the legal frameworks established during the development process. These include land covenants, body corporate rules and residents’ societies, which govern how shared spaces are managed and how people live alongside one another. Well-drafted rules help prevent disputes, ensure maintenance is carried out and support a sense of community.

Legislation has a key role to play in making better use of land for housing. In many areas, old land covenants (private rules between property owners, separate from council planning) are quietly stopping development. Removing these covenants is expensive and unpredictable. Either every affected owner has to agree (which is rarely practical), or you have to go to court and prove the covenant no longer makes sense.

Policymakers need to consider a better way forward, such as imposing a time limit on covenants, or flipping the current legal process on its head: instead of proving a covenant is outdated, those who benefit from it would need to show that the covenants still serve the neighbourhood meaningfully. Doing so could unlock a surprising amount of land for new housing without putting genuine neighbourhood protections at risk.

Done well, infill housing offers a practical, affordable and sustainable way to meet New Zealand’s housing needs. Whether you’re a homeowner with a large backyard or a landowner with a subdividable site, infill housing could be a smart way to unlock value. With expert legal and planning advice, and the right structure and support, you could turn unused space into valuable housing - and help your hometown grow responsibly.

Thinking about developing your property? Hilary Anderson is a Partner at Holland Beckett, specialising in urban development and infill housing.

This article was first published in the New Zealand Herald and Bay of Plenty Times, October 2025.

Fee Simple or Cross Lease titles – Key differences and the process for converting

If you own land or are considering purchasing it, understanding the type of ownership is essential.

Different estates come with unique characteristics that can affect how you use and manage the property. In New Zealand, there are several different land estates, each with its own advantages and disadvantages. Two common forms are fee simple (also known as freehold) and cross lease.

Fee Simple (Freehold)

Fee simple land is generally the simplest form of property estate in New Zealand. Owning a fee simple title means you have complete ownership of the land. This gives you flexibility to build or make changes without needing consent from other owners, unlike cross lease arrangements. However, your property is still subject to council regulations and any registered interests on the title, such as easements or land covenants, which may affect what you can do. Fee simple titles are often viewed more favourable to prospective purchasers when selling your property because they offer full ownership, autonomy, and no lease expiry dates and thereby potentially increasing the market appeal and value of the property.

Cross Lease

Cross leases are a type of title which were favoured in the 1960s by developers as a means to complete a subdivision in a flexible, expedient and less costly manner when compared to fee simple subdivisions. Cross leases are made up of two components. Firstly, the parties to the cross lease all own an undivided share of the underlying land and secondly, a lease for party of the land/building. Each owner of the land may then erect a building on their allocated area/segment of the land. This building will then be leased back to them (often for a term of 999 years) and recorded on the record of title.

The lease sets out the rights and responsibilities of each party sharing an undivided share of the underlying land, including a right of exclusive use and enjoyment for each building and usually the yard associated with that building.

Restrictions of Cross Lease Titles

Generally the lease contains rights and restrictions on what you can and cannot do on your property. The more significant restriction being the requirement to obtain your cross lease owners consent to any additions or alterations on the land and to any dwelling(s) on the property.

If consent of the other cross lease owner(s) is granted, you will also need to update the deposited plan / flats plan shown on record of title in order to accurately reflect the dwellings located on the underlying land which can be costly. If consent is not obtained or the flats plan is not updated or obtained prior to carrying out such works on your property, this may result in a dispute between owners or a defective title. This can affect the future on-sale of the property as under the latest ADLS Agreement for Sale and Purchase of Real Estate, a prospective purchaser may request that a new flats plan is deposited or you obtain consent from your neighbours for any unauthorised structures prior to settlement.

Benefits of Fee Simple Titles

While there are some advantages to maintaining cross leases, including having an element of control over what your neighbour / cross lease owner can and cannot do on their property, it may be beneficial to convert your cross lease title to a fee simple title. Full ownership then gives you the freedom to build, renovate and make changes without requiring consent from other owners.

Converting Cross Lease to Fee Simple

The first step is to discuss with your neighbouring cross lease owners to see if they are interested in converting to fee simple. If all parties are interested, then converting your cross lease involves the following:

Engaging a surveyor who will assess the underlying land as to the services and access to the dwellings. This stage may also include an assessment on whether separate services for sewage, water or drainage are required.

A Resource Consent would then need to be applied for from local council. Depending upon the property and area, council may impose conditions and works needing to be undertaken prior to granting consent.

Once consent is granted your surveyor will provide the plan to your solicitor. Your solicitor will then use it to draft the relevant documents to complete the cross lease conversion, including obtaining mortgagee consent (if applicable), drafting easements, covenants and preparing all ancillary documents necessary.

Once both your surveyor and solicitor have worked together to prepare the relevant documents and obtained the necessary consents, the documents and plans are lodged with Land Information New Zealand for separate fee simple titles to be issued for you and your neighbour.

Holland Beckett has a large, experienced property law team who have assisted many clients in converting to fee simple titles. If you would like any assistance with converting your cross lease, please get in contact with one of our property team.

Changes to the Public Works Act – additional compensation on the table for landowners

The Government recently introduced changes to the Public Works Act 1981 which provide for additional compensation for landowners who have their land acquired by agreement for certain projects. These projects are generally roading projects, based on those listed in the Fast-track Approvals Act 2024 or are identified as Roads of National Significance.

This will be of particular interest to local landowners who have land that will be used by NZTA for the Takitumu Northern Link - Stage 2 as this project is subject to the new compensation provisions and negotiations are already underway with landowners.

The Public Works (Critical Infrastructure) Amendment Act 2025 was passed on 26 August 2025 and is designed to speed up the land acquisition process for critical projects where a designation is in place or applied, or a resource consent is obtained. The new provisions involve:

Additional compensation as an incentive for landowners to reach agreement on land acquisition, being:

Recognition payment: 5% of total land value up to a maximum of $92,000 to recognise the land is being taken for critical infrastructure;

Incentive payment: 15% of the total value up to a maximum of $150,000 if the landowner reaches an agreement before the Minister or local authority serves a s 23 PWA notice (being the process to compulsorily acquire the land).

The landowner must give vacant possession in order to receive the additional compensation. The vacant possession date is by agreement, or within one month of the Minister or local authority giving notice that vacant possession is required.

Removal of the right of objection to the Environment Court for land that is taken for projects designated as critical infrastructure. Instead, a submission process is available where a landowner can make a submission to the Minister or local authority, with an opportunity to make a second submission following the Minister or local authority’s comments. The ability to object to the valuation tribunal for compensation remains.

These provision also apply for critical infrastructure projects where negotiations are already underway. There are exceptions for Māori land and an ability for agencies to opt-out of the above process and use the standard PWA process.

The key benefit of these changes is that landowners who are willing parties to land acquisition are able to obtain additional compensation (up to $242,000 depending on land value) if they reach early agreement with the Minister or local authority before it issues a s 23 PWA notice for compulsory acquisition.

It is therefore important to approach negotiations for land acquisition for such projects with these timeframes in mind to avoid inadvertently missing out on increased compensation.

There are further reforms expected to the PWA this year, including the requirement for compulsory mediation for compensation disputes, but these are not yet in force.

If you have any questions on the Public Works Act 1981 or this article, please contact our public works specialists: Bridget Bailey, Natasha van der Wal and Hilary Anderson.

Refinancing – things to consider before switching banks

With interest rates beginning to drop now might be a good time to consider replacing your current financial provider.

When you refinance you are taking out a new loan and using this to repay your existing loan. Here’s a rundown of key factors to keep in mind before making the switch:

Lawyers

Most banks will require you to have a lawyer to help you through this process. They will liaise with your current bank advising them of your intent to refinance, advise you on your new loan contract, receive your new loan funds and use those funds to repay your current loan. They will also ensure the existing mortgage (i.e. the instrument registered on your property’s title) is properly discharged and register the new mortgage on your property’s title. They also advise on any legal risks or obligations associated with the refinance. It is important to involve your lawyer at the start of the refinancing process so that they can ensure that everything runs smoothly.

Compare rates and consider break fees

Look at the interest rates offered by the new bank versus your current one. Take into account break fees - if you are refinancing during a fixed term under your current mortgage you may be liable to pay break fees. Break fees, also known as early repayment charges, are penalties that lenders charge borrowers when they repay a fixed-rate mortgage early or refinance to a new lender before the end of the borrower’s fixed interest rate term. You should get in touch with your current bank to see how much these may be. It is important that you have borrowed sufficient funds to repay all lending as well as any break fees.

Cash contribution

You should negotiate a cash contribution or a cash back. This is a special incentive that banks offer for switching to them and is essentially a reward or bonus for choosing them, the idea being that it often reduces your out-of-pocket-expenses. Most banks will offer a lump-sum payment of 0.8% - 0.9% of your total lending which is paid directly to your bank account after settlement. You generally do not have to pay back the cash contribution as long as you meet the terms and conditions of the loan offer, like keeping the account open for a certain period of time, typically a minimum of 3 years. However, if, for example, you refinance to another bank within that period you will most likely need to repay the cash contribution on a pro rata basis.

Insurance

Your new lender will need to be noted on your insurance certificate. Some banks also have specific requirements around insurance, so it is important that you check with your insurance company that your current policy is sufficient.

Security

Your lawyer will need to know if there are any existing guarantees or other securities which will need to be released and or discharged with your current bank. Banks do not automatically release these or bring them to your attention once lending has been repaid. If your new lending involves a company or a trust additional legal advice may be required.

Residential Care Subsidies

If you are approaching or have already reached 65 years and think you may require long-term residential care, did you know you may be entitled to a residential care subsidy?

What is the average cost of residential care in NZ per annum?

This annual cost of residential care varies based on a range of factors such as location, level of care and accommodation type.

Health New Zealand – Te Whatu Ora sets a maximum contribution for reach region, being the highest amount a resident can be charged for standard care.

Currently in Tauranga the maximum contribution is approximately $1,294.86 per week.

What is a Residential Care Subsidy (“RCS”)?

A RCS covers the difference between the actual cost of care and the applicant’s assessed contribution towards the care costs.

The RCS is paid directly to the care facility by Health New Zealand – Te Whatu Ora.

The subsidy covers the cost of standard residential care costs only, such as accommodation in a standard room, daily living assistance, nursing, prescribed subsidised medications, and routine GP visit.

It is important to highlight that the subsidy does not cover premium accommodation charges for features such as private ensuites or superior views.

An asset and income assessment is carried out to decide whether you are in a position to pay for yourcare yourself, and if not, your residential care subsidy entitlement.

What is the asset assessment for a RCS?

If you\'re 50-64 and single with no dependent children, you automatically meet the asset test.

If you’re 65 or older, the asset limit for individuals or couples where you are both in care is $284,636 or less.

If you’re 65 or older, and you have a partner who is not in long-term residential care you have two asset limit options:

$155,873 or less, if you don\'t want to include the value of your house and car; or

$284,636 or less, if you do want to include the value of your house and car.

What is the income assessment for a RCS?

An income assessment will be carried out to determine the applicant’s contribution towards the cost of care.

For the purposes of the income assessment, income includes:

NZ Super, Veteran\'s Pension or any other benefit.

50% of private superannuation payments.

50% of life insurance annuities.

Overseas Government pensions.

Contributions from relatives.

Earnings from interest and bank accounts.

Investments, business or employment.

Income or payments from a trust or estate.

The following is note included as income:

Any money your partner has earned through work.

A War Disablement Pension from New Zealand or any other Commonwealth country.

Income from assets when the income is under:

$1,236 a year for single people

$2,472 a year for a couple when both have been assessed as needing care

$3,707 a year for a couple where one partner has been assessed as needing care.

Can I gift assets in advance of moving into residential care?

You can gift assets to, say, family, friends, charity – but only up to a point.

There are two allowable gifting limits:

1. Gifts made within the 5 year period:

You are allowed to gift up to $8,000 of assets per couple per year in the last 5 years from when you apply for a RCS. This is a total of $40,000 of assets over the 5 year period with some spreading permissible during this period.

If you and your partner apply for a RCS at the same time, this amount will double to $80,000.

2. Gifts made outside of the 5 year period:

You are allowed to gift up to $27,000 of assets per couple per year outside of the 5 year period.

It is important to note that before gift duty was abolished in 2011, the allowable gifting threshold which applied in the context of gift duty was $27,000 per person per year. This does not align with allowable gifting in the context of RCS and can often catch applicants out.

Any gifting in excess of these limits will be considered as deprivation of assets.

In addition, interest not charged on outstanding debts can be capitalised when assessing eligibility for a RCS as part of the financial means assessment.

Will I be eligible for a RCS if I have a Trust?

Whether you are eligible for a RCS when you have a Trust will depend on your gifting history.

There is an expectation that trusts will voluntarily assist with long-term care costs. Where there is a closely held family trust with a history of providing for an applicant, trust income must be assumed to be available unless there are particular circumstances that demonstrate it is not.

Will I get to retain any of my pension?

If you are successful in applying for a RCS, a majority of your pension (or other NZ Superannuation or benefit) will be applied to their care costs.

You will retain a personal allowance of $56.58 per week.

In addition, you will receive an annual clothing allowance of $354.89 which is paid on 1 April in each year.

Residential Care Loans

What options do I have if I am unsuccessful in applying for a RCS?

Where an applicant is unsuccessful in applying for the RCS, they can consider a Residential Care Loan (“RCL”). A RCL is an agreement with the Crown to provide a loan for the cost of an applicants care.

To be eligible for a RCL, the applicant must own a property with an unencumbered title. A caveat will be registered against the property’s title which secures the loan.

The RCL will be paid on the earlier of:

The sale of the property; or

Within 12 months of the date of the applicant’s death.

Figures are assessed and updated annually on 1 July. These limits are accurate at June 2025.

Retirement Villages – Occupation Right Agreements FAQ’s

There are several things you need to have in place in order to move into a retirement village.

Residents need to have a valid Will and Enduring Powers of Attorney in relation to Property and Personal Care and Welfare.

Your solicitor will need to provide the village with copies of your Enduring Powers of Attorney prior to taking occupation of the unit.

Moving into a village will also involve signing an Occupation Right Agreement (ORA) or Licence to Occupy (LTO) with the retirement village. An ORA sets out the terms on which you can live in the village and the rights and obligations of both you and the village.

You will be required to pay an entry payment on settlement, being your purchase price to live in the Unit.

You will not own the unit like a freehold property, instead, you are given a right to occupy the unit and to use the village’s common areas.

Below we provide information to answer commonly asked questions around ORA’s.

What if my Trust is funding my entry payment?

Most villages don’t allow a Trust to be recorded as the licensee under the ORA.

If the entry payment is being funded by a Trust, there will need to be background documentation which records how those funds are being advanced, for example, by way of loan or by way of capital distribution.

If the Trust is advancing those funds by way of loan, Trustees need to consider the DMF and any additional charges that will be deducted by the operator on termination of the ORA and how that will be treated.

Most villages have a direction for payment on termination form that can be completed to record that on termination, the termination proceeds are to be paid to the Trust.

What if I change my mind?

Residents under every ORA have the benefit of a 15 working day cooling off period. Residents can terminate the ORA within 15 working days of signing it without having to give any reason. The DMF will not be charged where residents terminate under the cooling off period.

Some villages offer a 90-day money back guarantee. This guarantee allows residents to terminate the ORA within 90 days of the commencement date, if they are unhappy with their decision to move into the village or it does not meet their needs. The DMF will not be charged where residents terminate under the 90-day money back guarantee. Residents need to meet certain criteria to cancel under this right.

What is a deferred management fee (“DMF”)?

A DMF is the operators charge for managing and maintaining the village, your unit and the facilities.

The DMF is charged as a percentage of the entry payment up to a maximum 30%.

Some villages offer a choice in DMF at either 30% or 25% with the latter option having a higher entry price.

The DMF accrues over time, generally between the first 2 to 5 years of residency.

The DMF is charged on termination of the ORA, and is deducted from the monies owing to the outgoing resident.

What is a weekly village fee?

The weekly village fee is the resident’s share of the village outgoings which are payable by the operator.

Generally, the weekly village fee is charged monthly by direct debit.

Weekly village fees can be fixed, or subject to change. Generally, where a weekly village fee is subject to change, it is increased by the percentage change in CPI on 1 April in each year.

When the weekly village fee ceases to be payable differs between villages. Commonly, the weekly village fee ceases to be payable on the termination date of the ORA, provided the resident has vacated the unit and removed all of their possessions.

Will I incur any additional ongoing costs?

Separately to the weekly village fee, residents will be liable for all utility costs consumed in respect of the unit, such as electricity, gas, telephone, internet and in some cases water. Some villages purchase such utilities in bulk and build these costs into their weekly fees.

Where the unit is a serviced apartment, residents will also be liable for ongoing weekly service fees for services such as meals, laundry, cleaning etc.

Additional services charges for services such as hairdressing and podiatry, will be charged in addition to the regular fees.

What if I need a higher level of care?

Residents and their families should make enquiries as to what facilities or options are available for higher levels of care, such as serviced apartments, care suites and hospital/rest home facilities.

It is important to understand what terms apply to transfers within a village, for example, will you be charged a transfer fee and if so, how is this calculated.

Where a village offers care suites under an occupation right agreement, residents need to understand the DMF structure which will apply. Generally, where residents transfer from an independent living unit to a care suite, the DMF that has accrued under the independent living unit will not be applied to the care suite, and a second DMF will be charged on the care suite.

Often a DMF under a care suite will accrue at a faster rate, such as 12% in the first and second year of occupancy, and 6% in the third year. Some villages charge an initial % on the commencement date.

Can I terminate the agreement?

You can terminate an ORA at any time on giving the required notice and the ORA will terminate on your death or the death of the survivor of you (in the case of joint residents).

There are limited grounds on which the operator can terminate an ORA, such as where you can no longer live safely in the village, if you breach the terms of the ORA in a material way, if you cause any serious damage or distress to someone in the village, or you have permanently abandoned the unit.

When do I receive the money owing to me following termination?

Generally, residents will not receive the monies owing to them until the unit is re-licensed to a new resident, that resident has signed their ORA, the cooling off period has expired and they have settled their entry payment.

Some ORA’s provide that interest will be paid on the monies owing to a resident for the period from the date that is 6 months following the termination date until the date the resident is paid. Some ORA’s provide a village contribution rebate whereby the DMF starts accruing back/gets credited back if the unit hasn’t been re-licensed within 9 months.

If you are thinking of moving into a retirement home, contact Holland Beckett’s team for expert advice on ORA’s and planning for this phase of life.

Signed and sealed? Not so fast – why legal advice on your Master Build Contract matters

When embarking on a residential building project in New Zealand, many homeowners choose to engage a Registered Master Builder. One of the key documents involved in such projects is the Master Build Contract — a standardised building contract provided by the Registered Master Builders Association, which provides access to the well-known Master Build 10-Year Guarantee. While this contract offers protections for both parties and a structured framework for the build process, obtaining independent legal advice before signing is crucial. Here\'s why:

1. Understanding the legal implications

A Master Build Contract is a legally binding agreement. Legal jargon and standard clauses can sometimes obscure obligations or risks. A lawyer can clarify key clauses, such as:

Payment terms and what happens in case of delays or cost overruns

Liability clauses that may shift risk to the homeowner

Termination provisions and how you can (or cannot) exit the contract

This understanding helps you make informed decisions and avoids unpleasant surprises during the project.

2. Identifying potential risks

Although the Master Build Contract aims to protect both the homeowner and the builder, it may not always cover every scenario relevant to your specific project. Legal advice can help identify risks such as:

Ambiguous clauses that could be interpreted in multiple ways

Inadequate provisions for project delays or cost overruns

Unfavourable terms that could leave you financially exposed

A lawyer may recommend amendments or additional clauses to better protect your interests.

3. Customising the contract for your project

Every building project is unique, and a standard form contract may not cater to your specific needs. Legal professionals can help tailor the contract to:

Reflect agreed variations to the build

Include milestone-based payment terms

Address site-specific issues (e.g. land covenants, access, or zoning conditions)

Tie in with a contemporaneous land purchase

Customisation ensures the contract aligns with the realities of your build.

4. Protecting your financial investment

Building a home is often one of the largest financial investments a person will make. The Master Build Contract includes provisions around pricing, deposits, and progress payments — all of which can have major financial implications if misunderstood or mishandled. A lawyer can:

Review payment terms to prevent overpayment or under-delivery

Ensure retention money is handled correctly in accordance with the Construction Contracts Act 2002

Advise on guarantees and insurance coverage provided under the Master Build 10-Year Guarantee

When will I get my keys on settlement day?

Receiving the keys to your new home is a significant milestone. Clients often enquire about the exact timing on settlement day, especially if they are coordinating with moving companies or eagerly awaiting possession of their new home. Unfortunately, there is no “one size fits all” answer for when this will happen.

Before you can take possession, the settlement process must be completed. This involves payment of the purchase price and transfer of the property\'s title. The timing of this process can be a bit unpredictable on the actual day of settlement.

The key issue revolves around the exchange: the Vendor doesn\'t want to transfer the property without receiving payment, and the Purchaser doesn\'t want to pay without assurance of acquiring the property. Lawyers handle this by providing each other with \'undertakings\' – enforceable promises to carry out specific actions. These undertakings ensure everyone can proceed confidently with their respective tasks.

There are 2 undertakings given on settlement, one from each lawyer. The Vendor’s lawyer undertakes to transfer the property\'s title to the Purchaser upon receiving the settlement payment from the Purchaser’s lawyer. The Purchaser’s lawyer can then pay the settlement payment to the Vendor’s lawyer and undertakes that the payment will not be altered or withdrawn.

While this seems simple enough, there are several other steps that must align before you can get those precious keys.

If the Vendor has a mortgage, their bank must confirm the amount payable to discharge the mortgage. This amount is confirmed the morning of settlement to include interest to that date; a key factor contributing to time uncertainties. The Purchaser\'s lawyer cannot release the settlement payment until the Vendor’s lawyer has given their undertaking, received any loan funds (if bank financing is involved), and the Purchaser’s contribution is deposited into the lawyer’s trust account.

So, there is a bit of patience required on settlement day, but this ensures that the various factors align so you can take possession of the property without a hitch. Rest assured that your lawyer is working diligently to ensure a smooth transition, enabling you to step into your new home with confidence.

Registering Easements – Avoiding Unnecessary Delays

Registering easements can be a time-consuming process but there are ways to avoid unnecessary delays.

Engage Key Parties Early

The process to register an easement usually begins with the parties to the easement reaching an agreement to create an easement. This is usually between neighbouring properties which are intended to benefit from or be burdened by the easement. However, a party can obtain the benefit of an easement which is not connected to their ownership of any neighbouring property; this is known as an easement in gross. Sometimes creation of easements is imposed by a Council as a condition of granting consent to a subdivision and these compulsory easements have to be registered before the affected properties are able to be transferred into separate ownership.

Where easements are being voluntarily created, the parties should at a minimum reach an agreement in principle to create the easement and record this in writing before incurring surveying or legal costs. The parties may also wish to enter into a formal agreement to create the easement with a scheme plan of the easement areas attached which will be used as a starting point for creating a survey plan. Where a formal agreement is required, lawyers are often engaged to assist with preparing and/or reviewing the agreement.

Once the parties have reached agreement to create the easement, the next step is to engage a surveyor to prepare a survey plan of the easement areas. It is important that you engage a trusted, reliable surveyor. Unnecessary delays are often caused by surveying errors which end up needing to be corrected and slow down the easement registration process.

It is important to engage a lawyer early in the process too. Once a draft survey plan (Land Transfer (LT) plan) has been prepared by the surveyor this should be sent to your lawyer who can:

review the LT plan from a legal perspective;

advise you on the process to complete registration of the easement;

prepare the easement instrument; and

request any third party consents.

Putting your surveyor and lawyer in contact with each other early in the process enables them to coordinate effectively to ensure that registration can be completed in a timely manner.

Consider Location and Suitability of Existing Access and Easement Equipment

Where a right of way is being granted over an existing access way it is important to make sure that the surveyed easement areas shown on the LT plan align with the actual location of the access way. The parties may also need to consider whether the existing access way is sufficient for the intended use and any increase in use by the parties. For example, where no suitable access way exists in respect of a vehicular right of way, the benefiting users have the right to establish a suitable access way and the parties share those costs unless agreed otherwise.

Where there will be an increase in use of the access way or the nature of the use will change, for example heavy goods vehicle using an access way which was previously only used by light vehicles, it is important for the parties to engage appropriately qualified roading contractors to investigate whether upgrades to the access way are required and if so for the parties to reach agreement as to how those upgrade costs will be apportioned.

Where easement rights are granted in respect of existing underground equipment such as pipes for conveying or draining water or underground electricity or telecommunications lines, additional care needs to be taken to ensure that the surveyed easement areas shown on the LT plan align with the location of that equipment. This can be determined with reference to as built plans, and you should ensure that your surveyor has a copy of those plans when they start preparing the LT plan.

Drafting Documents

Easement instruments are typically drafted by lawyers, but certain organisations like Council and electrical lines companies often require their own easement template forms be used as a starting point which reduces the scope for negotiation. If you are granting Council or a lines company an easement over your property, then they will typically provide their easement template to your lawyer so that it can be populated with the relevant details.

The terms of the easement instrument will depend on the nature of the easement and its use. For common easements such as rights of way or rights to drain water between a few properties, the implied easement terms in the Land Transfer Regulations 2022 and Property Law Act 2007 are usually sufficient. These are standard terms that lawyers are familiar with so it is unlikely that negotiation of these terms will be required. For less common easements such as party wall easements and loading bay easements, bespoke terms will need to be drafted into the easement instrument which will need to be reviewed by the lawyers acting for other parties and increases the likelihood of protracted negotiations.

Consents

Consents may be required from third parties in order to register an easement. A couple of common examples of consents are:

Where a mortgage or caveat is registered against the title to any of the burdened land, the consent of the mortgagee and caveator to registration of the easement will be required. Typically, mortgagee and caveator consent is requested once the LT plan is drafted and the easement instrument is in agreed form.

Where the easement instrument includes a private road or private way, Council’s consent is required. This is known as a section 348 certificate and must be registered together with the easement instrument.

Survey Plan Approval

The LT plan needs to be approved by Land Information New Zealand (LINZ). Your surveyor will submit the LT plan to LINZ for approval together with any other necessary approvals. For example, where the LT plan is being deposited as part of a subdivision, Council approval to the LT plan will be required under section 223 and often section 224 of the Resource Management Act 1991.

If you are looking to register an easement over your property, we recommend you talk with the Holland Beckett property law team so that we can assist you with keeping the process moving forward smoothly and avoid unnecessary delays.

Buying Your First Home – A Guide

Purchasing your first home is an exciting experience but can also be a daunting one. There are a lot of things you need to know when you’re looking to make that first step. Below is a guide for first home buyers looking to enter the property market.

It is often tempting to put an offer in on a property as soon as you have walked into the first open home but there are a few things you should look at before signing the Agreement for Sale and Purchase.

Budget

The first thing to consider is your budget. The Bank will generally require you to have a 20% deposit which is often challenging for first home buyers, however there are options available to help which include your personal savings, your Kiwisaver (provided you have been a contributing member for at least three years and are eligible for a first home withdrawal) and gifting, loans and guarantees from family. It is important to be realistic about the amount you can afford while also taking into consideration how much the vendor is expecting to get for the property.

Type of Property

The second thing to consider is what type of property you are buying. In New Zealand there are four main types of property, these are:

Freehold also known as Fee Simple;

Cross Lease;

Unit Title; and

Leasehold.

Therefore, before you put your offer in or during your due diligence, it is a good idea to review the Record of Title to the property to ascertain what restrictions or interests you should be aware of. For example, while a property may be freehold, it could be subject to easements and covenants, among other interests, that may impose obligations on you as the property owner or restrict any plans you may have for the property.

Conditional or Unconditional?

The third thing to consider is the type of offer. There are two options when making an offer on a property, which are a conditional offer or an unconditional offer. An unconditional offer is one where there are no conditions attached to the offer, and you carry out your due diligence prior to making the offer. A bid at auction is an unconditional offer and you will be advised of all the due diligence you need to complete before the auction day. A conditional offer is one where you can specify conditions that must be satisfied before you declare the Agreement for Sale and Purchase unconditional and all conditions must have a timeframe attached.

What kinds of conditions should you include in your offer?

Not many first home buyers can put in a cash unconditional offer, and we generally wouldn’t recommend it as this may be one of the biggest investments and you will want to ensure you complete your due diligence on the property to be satisfied with all aspects of the property.

We can prepare your offer to the vendor of the property or review an offer prepared by a real estate agent before you sign. A few of the most common conditions included in agreements are as follows:

Finance– you may already have pre-approval from your bank but there may be conditions attached to the approval such as a requirement to obtain a registered valuation of the property or a building report, both of which can take a number of days. In addition, if you will be using your Kiwisaver as part of the deposit, you will need to ensure the finance condition is at least 10 to 15 working days so your Kiwisaver provider can process your application and you can complete any checks required by your bank. It is important that you have a confirmed offer of finance before the agreement becomes unconditional.

Building report– This is a report undertaken by a registered building inspector. They will assess the property and indicate any areas of concern, highlight issues that need to be resolved in the property and give you a better indication of the condition of the property you are looking at purchasing.

LIM– This is a Land Information Memorandum, a report provided by the local council which will tell you if building works have been consented to, provide information regarding council services to the property (such as sewerage and water) and highlight any possible risks known to the council affecting the property such as flooding or erosion.

We can also recommend bespoke conditions, depending on the type of property and your particular circumstances. We can help look through building reports and LIMs and highlight key issues you should be aware of. Should these documents raise issues, we can liaise with the vendor’s solicitor to request they rectify any issues prior to settlement or negotiate a price reduction as a result of any issues the property may have.

In an ideal world, your offer would be conditional upon as many conditions as you feel are necessary but consideration should be given to the number of conditions you put in your offer so you can put your best offer forward.

Pre-settlement inspection

The vendor also leave behind a number of chattels (such as carpets, heat pumps, dishwasher and stoves) in the property, so while you inspect the property it is a good idea to note the conditions of the chattels. If you go unconditional on the property, you will be able to inspect the property again before the settlement date and check all the chattels are in reasonable working order and in the same condition as you first inspected them, this is known as a pre-settlement inspection.

Insurance

It is also important to liaise with insurance companies as you will be required to hold sufficient house insurance prior to the settlement date. If your bank is providing a mortgage for the property, your bank must be recorded on the policy as the interested party. Have a look at insurance options, read the policy wording and get a home insurance quote which will help you understand the terms of the insurance cover and its cost so you can account for it in your budget.

Before you sign an agreement for sale and purchase, or bid at auction, we recommend you talk with us and we will make assist to make sure that the process run smoothly. Once you have an unconditional offer on a property we will prepare all necessary documents and attend to settlement on your behalf. We pride ourselves on assisting first home buyers and making your first home purchase as stress free as possible.

Hot Tips for Purchasing Property in Rotorua

Rotorua is a wonderous place, known for its cultural significance to Māori, its geothermal activity, many lakes and tourism (to name but a few). From those seeking adventure, mountain biking in the redwoods, or taking some time to bask in one of the many day spas, Rotorua has something to offer everyone.

For those seeking to permanently secure a foothold in Rotorua, we’ve collated a selection of relevant factors for the prospective purchaser to consider when looking at Rotorua residential property:

Geothermal Activity

Geothermal / volcanic activity is part of the natural landscape and surrounds of Rotorua. Undertaking due diligence in this regard at the outset will help to mitigate unexpected surprises.

This includes checking that you will be able to secure insurance (without exception).

Note: Insurance is critical if you are obtaining a mortgage.

Geothermal Bores

While it may seem unusual, some properties in Rotorua are heated through access to a geothermal bore. If the prospective property you are looking at purchasing does have access to a geothermal bore, we suggest you check matters such as:

Whether there are any known issues with the supply/users of the bore;

The maintenance contribution you would be liable to pay (including the amount and frequency);

Who manages the bore. For example some areas have a geothermal bore association who meet on a regular basis; and

How to transfer the right to use the bore, if applicable.

Water Supply

The Rotorua Lakes Council (Council) has two methods of charging for water use:

Unmetered properties – these properties are charged a set annual charge included in their general rates.

Metered properties – these properties receive separate quarterly invoices, based on the actual volume of water consumed.

Council operates 10 water supplies for urban, rural residential and farming supplies. These supplies do not receive any funds from general rates and are funded through water charges.

You should check if water use for your property is metered and if it is subject to any additional water charges.

Air Flight Path

Rotorua has the benefit of a domestic airport in Ōwhata.

Properties that are located near the airport (where applicable) may be in areas of high Airport Noise, this will be noted on the Council file.

The airspace above the property may also be designated on flightpaths to the airport, this will also be noted along with any restrictions such as the height of trees and property or the use of drones.

You should check whether the property you are looking to purchase is subject to Rotorua Regional Airport Noise Control and Mitigation requirements and if there are any restrictions associated with this.

Jetty’s

If you are looking at buying or selling a home with a Jetty ensure you understand your obligations.

This includes the transfer of the resource consent (if applicable), the resource consent terms and the costs.

Fireplaces and the ‘Point of Sale’ Rule

Check whether the property falls within the Rotorua Clean Air ‘airshed’ which requires non-compliant fires and wood burners to be decommissioned or removed.

If the home has a solid fuel heater and it is not on the list of compliant solid fuel heaters it must be decommissioned with a certificate filed with Council by an appropriately qualified person.

It is a requirement at the time of sale, (which is a seller’s obligation).

Leasehold Titles

Sometimes, you will come across some well-priced lake-front (or near to) properties that are comparably lower than some surrounding homes and the \'good price\' may be attributed to those properties being “leasehold” titles.

A leasehold, generally speaking, means you have a “leasehold” title that is subject to a lease which includes the leasehold owner paying ground rent. There is someone else who owns the “fee simple” or “freehold” of the underlying land (the ‘Landlord’ or Lessor) who you pay that rent to.

You only have the right to exclusive use of the property for the time specified in the lease (subject to any renewals).

The lease should be carefully reviewed and understood by you prior to purchasing as your use and occupation is subject to the terms of that registered lease.

General

If you are considering purchasing (or selling), seek legal advice prior to signing an agreement (this is to ensure that your I’s are dotted, and your T’s are crossed).

To protect your interests, we can assist in reviewing your agreement to ensure the appropriate clause(s) are included in the sales and purchase agreement.

If you are looking to secure your own piece of paradise in Rotorua, reach out to our property team for legal advice, prior to signing the agreement. As the saying goes, it is much easier to negotiate before you sign!

Land Covenants – protecting or preventing development?

Land covenants are very commonplace in modern subdivisions and often impose significant restrictions on the way a property can be developed and used, now and into the future (sometimes indefinitely).

While usually intended to promote and protect the amenity of subdivisions and preserve property values in the years to come, covenants can stymie development, prevent neighbourhoods from moving with the times and create difficulties for owners trying to renovate and extend or sell their properties.

Common issues are:

Requirements that the developer or other third party approve in writing any plans and specifications for construction of buildings on the land. Often these requirements are overlooked, and approval is not actually sought or there is nothing in writing to show that this requirement was complied with. This causes issues when the property is sold as a purchaser inherits (and could be required to fix) any covenant compliance issues when they buy a property. These requirements can also be written in such a way that it’s not clear whether approval has to be obtained for the initial construction of buildings on a property, or whether the obligation is ongoing and approval must be obtained for any new additional buildings (like a tiny home or extra garage) or changes to original buildings - which would cause further issues if the developer no longer exists.

Prohibitions on subdivision or the number of dwellings that can be constructed. It is very common for covenants to specify that only a single dwelling can be constructed on a property, which can prevent an owner from redevelopments such as converting their property into a home and income and inhibits intensification of residential land.

Inflexible material requirements, like obligations to use only certain types of cladding, which have become obsolete or problematic over time. These requirements can also prevent the use of new superior materials and building innovations.

While it is possible to place a time limit on residential land covenants or to update or remove them, the current legal pathways can be complex and time-consuming—particularly when the original covenants do not provide for such changes.

At present, modifications or removals can be pursued by:

Securing unanimous consent from all owners in the affected subdivision. This is often impractical due to the number of parties involved and the potential for disagreement or requests for compensation.

Applying to the Court under sections 316 and 317 of the Property Law Act 2007. While this process can be burdensome and uncertain, our team has successfully guided clients through several such applications. To succeed, applicants must typically demonstrate that:

There has been a material change in the use of the land or the character of the neighbourhood;

The covenant unreasonably restricts the property’s use; and

No party would suffer substantial detriment from the change.

Given the complexity and cost of these processes, its high time the government considered introducing a statutory time limit on residential land covenants. In the meantime, if you\'re buying, selling, developing, or redeveloping a property that may be affected by covenants, our experienced team is here to help—please get in touch to discuss your options.

Hilary Anderson joins Holland Beckett as Special Counsel

Holland Beckett is pleased to announce that Hilary Anderson has joined the firm as Special Counsel.

Hilary is a specialist property and commercial lawyer and joins our property and commercial law practice working closely with Dean Thompson and his team.

“The appointment comes at a time of significant momentum for the firm as we grow our commercial and development practices,” says Dean Thompson, Partner at Holland Beckett. “Hilary has always impressed us in past dealings with her common sense and commercial approach. She will be a great addition to the team.”

Hilary enjoys a wide variety of work for private clients, property developers and commercial clients, with expertise in residential and commercial property transactions and finance, property development, conveyancing, subdivisions, commercial leasing, franchising and contract matters. She also has a special interest in trusts, asset planning and protection with significant experience in complex or large estates. Named as one of New Zealand Lawyer’s Rising Stars in 2022, Hilary is a driven but straightforward and approachable lawyer.

Born in Ōhope, Hilary has strong connections to Whakatāne and the Eastern Bay of Plenty. She has called Tauranga home for more than a decade and has strong relationships and an incredible reputation in the community.

Holland Beckett is delighted to have identified a talent and to have her join the team at a time of growth. The Bay of Plenty based firm has almost outgrown their current Tauranga premises and will move to new offices in the CBD next year, marking the next phase in the firm\'s success. Dean Thompson adds, “we have always got room for good people.”

Please reach out to Hilary for any property or commercial enquiries hilary.anderson@hobec.co.nz or 07 571 3836.

Are you purchasing your first home? Completing a Kiwisaver First Home Withdrawal may help you get on the property ladder.

To complete a Kiwisaver First Home Withdrawal you need to have been a member for at least three years. These funds must be applied toward the purchase of a residential property which you intend to live in for at least six months.

If eligible, you can withdraw all your Kiwisaver savings other than $1,000 which you must keep in your Kiwisaver account.

The funds from your First Home Withdrawal may either be applied towards the payment of a deposit where you have entered a conditional agreement or towards the balance required to purchase the property on the settlement date. A withdrawal application cannot be completed until you have a signed agreement to purchase a property.

Most Kiwisaver providers take between ten to fifteen working days to process a withdrawal on receipt of your fully signed application. The amount of days your particular provider requires is set out on their respective first home withdrawal form which can be found online. Depending on whether you are wanting to use Kiwisaver funds for the deposit on the unconditional date or on the settlement date, you need to ensure that you give your provider enough time before your required date to complete the withdrawal. This can catch out first home buyers wanting to use their Kiwisaver funds to pay a deposit on a property going to auction, as at auction the deposit is usually payable the same day you sign the agreement upon your winning bid.

The withdrawal forms include a statutory declaration to be signed whereby you declare that you are eligible to make the withdrawal. Only certain people can witness signing of the statutory declaration including a Solicitor, Justice of the Peace or Notary Public. These forms also include a letter to be signed by your Solicitor. It is important that you factor in these signing arrangements when determining the timeframes required to withdraw funds.

Once your application is processed by your provider, your Kiwisaver funds are paid to your solicitor. Your solicitor will then use these funds to either make payment of the deposit or towards the purchase price on settlement.

We are well experienced at dealing with Kiwisaver providers. If you have any questions or would like any assistance with buying your first home, please get in contact with one of our property solicitors.

Bright-line Tax Changes – What You Need To Know

It is a bright day for some property owners this July with the relaxing of the Bright-line Test requirement.

What is the Bright-line Test

The Bright-line test sets a out a timeframe where if a sale of a residential property occurs, the profit gained may count as income and therefore be taxable. However, some exceptions or rollover reliefs may apply that sidesteps the Bright-line rule.

The Bright-line Test Historically

From its inception in 2015, the Brightline test was set for a period of 2 years. A first amendment extended the period to 5 years if residential properties were purchased between 29 March 2018 and 26 March 2021. A further amendment was then made for residential properties purchased between 27 March 2021 and 30 June 2024 to have the Brightline period for 5 years for qualifying new builds or 10 years for other residential properties.

Bright-line Latest Changes

As of 1 July 2024, the Bright-line period is reduced back down to 2 years. So, residential properties sold on or after 1 July 2024 that is outside the 2-year period from when it was purchased will not be subject to the new Bright-line test. However, other tax obligations may still apply particularly to those who make a living out of buying and selling residential properties. Tax obligations may also apply if caught by the “intention test”, the idea being that if you buy a property with the intention of re-selling it to make a profit, you can be taxed.

Some Exceptions to the Bright-line Test

The Bright-line test does not apply if you are selling your main home. However, the main home must have been used “predominantly, for most of the time” during the period you own it.

The test also does not apply to residential properties transferred to the executors, administrators or beneficiaries of a deceased estate.

Rollover Relief

A rollover relief may also apply. This is when a transferee to whom the residential property is transferred is deemed to have acquired the residential property at the same time as when the transferor acquired the residential property.

Rollover reliefs may apply between transferors and transferees who are associated persons such as transfers between certain family members, some transfers of trust property, transfers of relationship property or transfers resulting from separations. However, the associated persons must have been associated for at least 2 years prior to the date of the transfer of residential property.

Conclusion

Only so much can be said in this article regarding the tax implications in selling a property. It is always prudent to seek legal and tax advice from a qualified professional when doing so. But at least the time frames for Bright-line which was resulting in profits from many rental property sales being taxed have been reduced from 1 July 2024. Please feel free to contact us for specific advice on your rental property sales.

Reverse Mortgages

A reverse mortgage is a loan for people over 60 years of age that allows them to access equity in their property in order to release cash to them.

We see plenty of clients that have benefitted from these loans in allowing them to e.g. fund necessary improvements or maintenance to their property to enable them to stay in their own home longer or for other purposes such as a more comfortable retirement in light of the increasing costs of living.

The key attraction of a reverse mortgage loan is that you don’t need to make regular repayments, and generally repayments can be made at any time without penalty. Instead, they service the interest every week, the interest is just added to the loan balance and accumulates. Your total loan is repayable upon what is commonly called a ‘payment event’, which is where you may sell your property, move into a retirement village or upon your death. There is a limited ability to transfer the loan to another property if you move.

Interest rates are generally higher than standard registered bank loans and borrowers need to understand the implications of these higher rates. In the current market, property values are not increasing as fast as they have in the past so the equity in your home could be depleted too fast given there are no increasing property values to offset losses.

Due to the accumulation of interest at a higher rate, if you wish to sell your house and purchase a new house, or move into a retirement village in future, this may be more difficult to achieve as the equity you have left in your property may have reduced to an insufficient sum necessary for the subsequent purchase.

Nevertheless, reverse mortgages can be an appropriate way of making funds available to you. The additional funds can support living expenses, healthcare costs or other needs. We are commonly instructed by banks to provide legal advice regarding these loans. Following our advice, our work involves discharging any existing mortgage, registering your new reverse mortgage and attending to any estate matters which may arise as part of our discussion.

If you require any legal assistance on a reverse mortgage, please get in touch.

Buying property with family – fun or potential fiasco?

In the present economic climate, getting into (or climbing) the property ladder is tough. To get a deal across the line, purchasers are increasingly looking to alternative ownership options.

One such option we commonly see is ‘co-ownership’ of property between family members. Taking matters a step further than the traditional parental guarantee of a child’s purchase, we are now seeing co-ownership between multiple relatives (such as siblings and their spouses, or parents and all/some of their children). This is despite that not all owners intend to live in or maintain the property.

While this sounds good on paper, unfortunately these arrangements often proceed without the appropriate documentation and can go wrong. Untangling them can be complex where there has been intermingling of purchase funds, family members not being treated equally, deaths occurring and relationships souring over time.

What to do if you want to buy property with other people?

If you are buying property with others (often who are not your spouse or partner), you should have a written agreement to cover key aspects.

The terms can cover:

ownership shares and monetary contributions to purchase (including bank loans);

who will live in the property;

who will pay property expenses and maintenance;

what will happen if someone wants to sell the property and others don’t;

what happens on death of a party;

and how will any proceeds of sale be distributed.

This way, if a dispute does arise there will be a clear path forward to minimise any fall out (if possible). Property Sharing Agreements are used to document these arrangements, which are simple but effective. Purchasers can also consider whether funds should be gifted or loaned. Our property lawyers can assist you with this process. You can also read our article on Gift v Loan.

If you are wanting to buy property with your partner or spouse, there are a different set of questions and documentation to consider (for example, whether you need a contracting out agreement). Our dedicated family team can advise you on all aspects of relationship property. See also our article on Contracting Out Agreements 101.

When it goes wrong

A recent example of an undocumented family property purchase is the case of Boot (As Executor and Trustee of Estate of Hart) v Stephens [2023] NZHC 3863.

Parents (the Harts) helped their daughter and her husband (the Stephens) buy a property. The title said that each couple owned a 50% share of the property, but in reality, the Stephens contributed more to the purchase price. They also paid for most of the property expenses in that time. Years later, both the Harts died, and their other five children wanted to sell the property so that 50% of the sale proceeds could be distributed to the children via their mother’s estate. The Stephens claimed that they were entitled to 67% of the property. Additionally, they had lived in the property for 17 years and did not want to sell. Ultimately, the Court held that, given the family’s intentions and contributions, the Stephens were entitled to 66% and could buy out the estate’s 34% interest. Regrettably, the dispute and litigation took a toll on the siblings’ relationships.

If you own property with your family and there is a dispute

There are a number of options to resolve a dispute if there is no written agreement, including obtaining Court orders to force a sale under the Property Law Act 2007.

First and foremost, our experienced litigation lawyers can help you to resolve matters before Court through negotiation or mediation, if possible. If negotiations are not successful, we can guide you through the litigation process.

Cancelling a lease for breach of covenant or condition – Notice requirements under the Property Law Act 2007

The Property Law Act 2007 (Act) provides a “code” governing the cancellation of a lease by the lessor (Landlord) for breach of covenant or condition by the lessee (Tenant). The “code” is contained in sections 244 to 264 of the Act (Cancellation Code).

The codification of the lease cancellation provisions of the Act means that, on breach of a covenant or condition by the Tenant, the Landlord may only cancel a lease in compliance with the requirements of the Cancellation Code. Landlords and Tenants cannot contract out of the Cancellation Code. Any Lease containing terms which are inconsistent with the Cancellation Code, or which attempt to avoid the provisions of the Cancellation Code, are ineffective and unenforceable.

The Cancellation Code provisions of the Act must be strictly followed if a lease cancellation is to be deemed lawful. A Landlord who fails to follow the statutory procedure when cancelling a lease is exposed to the risk that the Tenant challenges the cancellation and seeks relief against the Landlord.

In this article we summarise the statutory notice requirements contained within the Cancellation Code. These requirements must be complied with by the Landlord when exercising a right to cancel a lease for breach by the Tenant.

When a Landlord’s right to cancel may be exercised

In the event of a breach of the lease provisions by the Tenant, the Landlord may exercise a right to cancel a lease by:

applying to the court for a possession order of the land; or

re-entering the premises peaceably and without committing forcible entry under section 91 of the Crimes Act 1961.

However, before exercising a right to cancel, the Landlord must first comply with the Cancellation Code.

Section 245 – Cancellation of lease for breach of covenant to pay rent

If the Tenant is in breach of their obligation to pay rent then the Landlord may exercise a right to cancel the lease only if:

the rent has been in arrears for at least 10 working days;

the Landlord has served on the Tenant a notice of intention to cancel the lease for breach of the obligation to pay rent (s245 Notice); and

at the expiry of the notice period specified in the s245 Notice, the breach has not been remedied.

The s245 Notice must “adequately inform” the Tenant (or other recipient) of the following:

the nature and extent of the breach;

the amount that must be paid to remedy the breach;

the period within which the breach must be remedied, being not less than 10 working days after the date of service of the s245 Notice (remedial period);

the Landlord’s right to cancel the lease if the breach is not remedied within the remedial period; and

the Tenant’s right to apply to a court for relief against cancellation of the lease and that the Tenant should seek legal advice on the exercise of that right.

“10 working days”

There are two periods of 10 working days referred to in section 245:

the first is the period for which rent must be in arrears before the Landlord can exercise a right of cancellation for non-payment of rent; and

the second is the minimum period that the Tenant must be given under the s245 Notice to remedy the breach.

Importantly, section 245 allows the two 10 working day periods to run concurrently.

Before exercising a right to cancel a lease under section 245, it is important that the Landlord check the specific terms of the lease. The statutory power to cancel a lease for non-payment of rent, or other breach, implied into leases by the Act requires that rent must be in arrears for at least 15 working days before the Landlord can exercise the right to cancel. However, if the lease contains an express provision entitling the Landlord to cancel the lease for non-payment of rent earlier than the implied 15 working day period, the express provision prevails. Most standard form leases specify a rent arrears period of 10 working days after the date the rent payment was due.

Section 246 – Cancellation of lease for breach of other covenants

If the Tenant is in breach of a condition or covenant in a lease other than the covenant to pay rent, for example failing to adequately maintain the premises or remove rubbish, the Landlord may exercise a right to cancel the lease only if:

the Landlord has served on the Tenant a notice of intention to cancel the lease for breach (s246 Notice); and

at the expiry of a period that is “reasonable in the circumstances”, the breach has not been remedied.

The s246 Notice must “adequately inform” the Tenant of the following:

the nature and extent of the breach;

if the Landlord considers the breach is capable of remedy by the Tenant doing or stopping doing a particular thing, or by the Tenant paying the Landlord reasonable compensation, or both:

- the thing the Tenant must do or stop doing; or

- the amount of compensation the Landlord considers reasonable;

the Landlord’s right to cancel the lease if the breach is not remedied within the expiry of a period that is “reasonable in the circumstances”;

that certain defects in the s246 Notice do not invalidate the notice; and

the Tenant’s the right to apply to a court for relief against cancellation of the lease, and that the Tenant should seek legal advice on the exercise of that right.

“Reasonable in the circumstances”

The s246 Notice must give the Tenant a period of time that is “reasonable in the circumstances” to remedy the breach. However, the Cancellation Code does not require the Landlord to specify in the notice what that period will be. To give certainty to both parties, we recommend a date be specified in the s246 Notice.

What constitutes a reasonable period of time will depend on the circumstances of the matter and the ‘thing’ that the Tenant must do, or stop doing, to remedy the breach. Because of the potential ambiguity around what a reasonable period will be – what one party considers reasonable may not necessarily be considered reasonable by another – we recommend careful consideration be given to each matter and its specific circumstances. We can provide case-specific advice in this regard.

“Adequately inform”

Both sections 245 and 246 require that any notice given by a Landlord to a Tenant must “adequately inform” the Tenant of what the breach is, how the breach can be remedied (if at all) and, in respect of an s245 Notice, the date by which the breach must be remedied. The primary purpose is to give the Tenant an opportunity to remedy the breach and to put the Tenant on notice that, if the breach is not remedied, the lease will be cancelled.

Care must be taken in preparing an s245 or s246 Notice to ensure that the notice is compliant with the Act and accordingly can be acted on immediately, if required, without the need for further notice or time to be given.

Service

As the Landlord’s right to cancel a lease for breach stems from the provision and expiry, without remedy, of an s245 or s246 Notice, it is imperative that any notice is effectively and validly served on the Tenant (and other relevant persons/parties if required), in compliance with the provisions of the Act.

Failure to adequately serve a notice could result in the notice being unenforceable, or open to challenge by the Tenant, meaning wasted time and costs for the Landlord. We can provide advice on, and arrange for service of, s245 or s246 Notices to ensure compliance with the Act.

Any notice issued under sections 245 or 246 of the Act must comply with the Cancellation Code, the notice must be correctly drafted and adequately served. A prudent Landlord should strictly comply with this ‘first step’ to ensure the swift and effective cancellation of a lease in order to save time and costs, and to minimise any loss going forward.

We can provide advice in all areas of the Property Law Act and the Cancellation Code.

Building and weathertightness defects – information for Body Corporates and owners

The apartment building is suffering from building defects, what should be done?

Defects (whether workmanship, or materials) commonly lead to weathertightness issues and further deterioration of the building and materials. Depending on when the building was constructed, or previous remedial work carried out, there may also be various warranty periods that are important. Where an owner or the body corporate is aware of possible defects, the first steps are to commission an independent inspection by a registered building surveyor/inspector to determine the nature and extent of the defect and identify whether any warranty or limitation periods are about to expire.

Deterioration of materials, potential defects, and maintenance issues, are likely to be identified through the process of a body corporate preparing or reviewing its long term maintenance plan, by an owner noticing the potential problem or by the body corporate and/or building manager. Encouraging regular reporting on these matters may be helpful.

Who should commission the report/investigation?

Both owners and the body corporate have obligations to repair and maintain. Whether the body corporate or an individual unit owner should commission the inspection and report depends on the type and location of defect or concern.

An owner can commission the investigation if the defect is confined to an individual unit and not a “building element” or “infrastructure”. However, the owner is unlikely to have any obligation to share the report and findings with the body corporate or other unit owners.

Where the defect is believed to be widespread or systemic, the body corporate is likely to be better placed to commission the report. If the investigation concerns common property, building elements, or infrastructure, then the body corporate has a responsibility to repair and maintain and should therefore commission the report.

The investigation report has identified building defects, what should be done?

This creates two separate issues. Depending on the nature of the defect, the body corporate or owner(s) may need to repair it. If the defect is a result of material or workmanship failure and within a warranty period and/or limitation period, the body corporate and owners are likely to have a claim against the responsible parties (building contractors, developers, local authorities, architects, etc) for the costs of repairs, together with other costs (such as general damages for loss of rent or use, alternative accommodation; investigation costs and legal expenses).

The process of repairing extensive defects and bringing claims against responsible parties are complex, particularly for body corporates. It is critical that professional advice from building and construction specialists and lawyers is sought to ensure the correct processes are followed and necessary evidence obtained to prove the damage and losses.