Holland Beckett is pleased to announce that Hilary Anderson has joined the firm as Special Counsel.

Hilary is a specialist property and commercial lawyer and joins our property and commercial law practice working closely with Dean Thompson and his team.

“The appointment comes at a time of significant momentum for the firm as we grow our commercial and development practices,” says Dean Thompson, Partner at Holland Beckett. “Hilary has always impressed us in past dealings with her common sense and commercial approach. She will be a great addition to the team.”

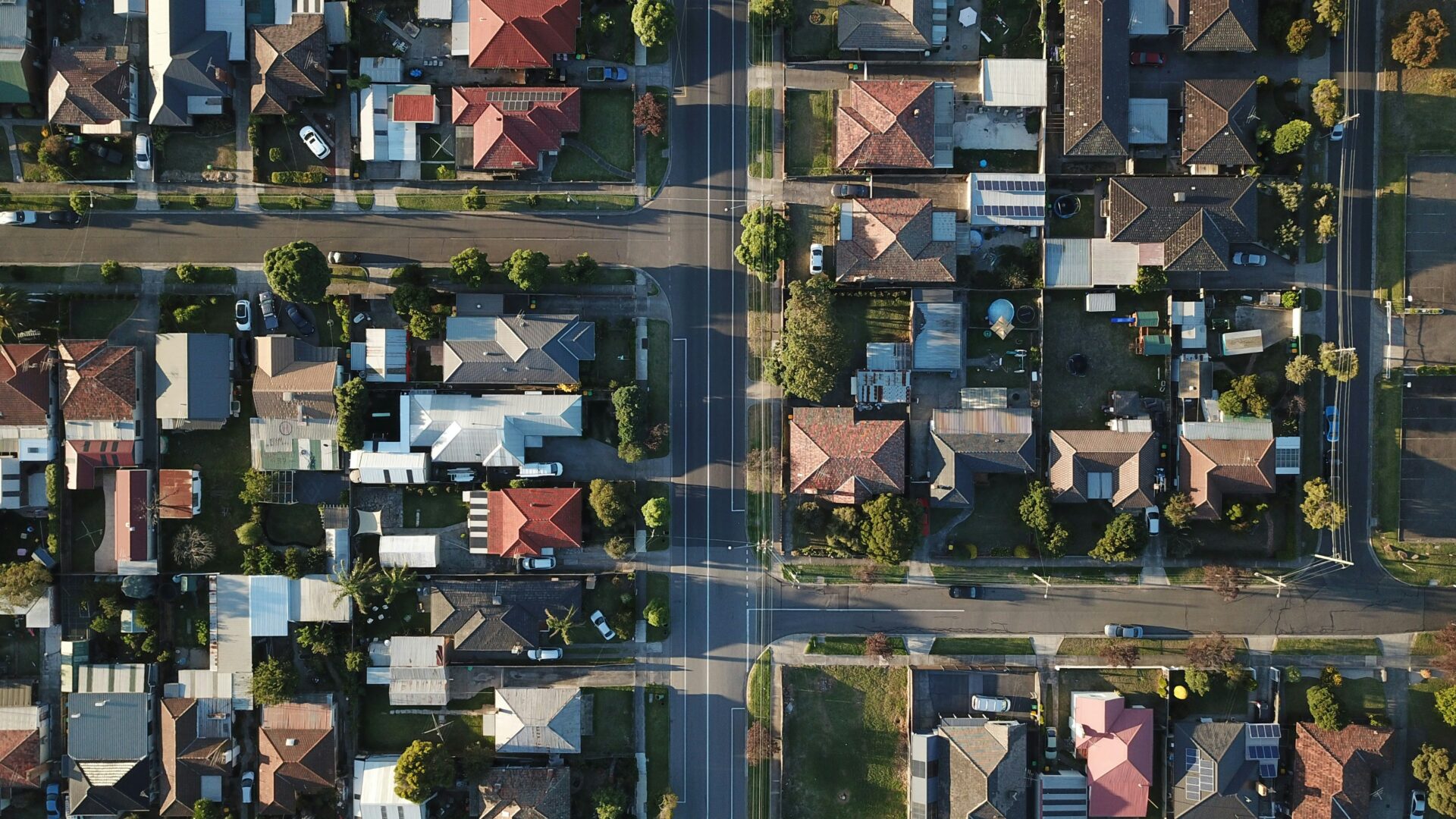

Hilary enjoys a wide variety of work for private clients, property developers and commercial clients, with expertise in residential and commercial property transactions and finance, property development, conveyancing, subdivisions, commercial leasing, franchising and contract matters. She also has a special interest in trusts, asset planning and protection with significant experience in complex or large estates. Named as one of New Zealand Lawyer’s Rising Stars in 2022, Hilary is a driven but straightforward and approachable lawyer.

Born in Ōhope, Hilary has strong connections to Whakatāne and the Eastern Bay of Plenty. She has called Tauranga home for more than a decade and has strong relationships and an incredible reputation in the community.

Holland Beckett is delighted to have identified a talent and to have her join the team at a time of growth. The Bay of Plenty based firm has almost outgrown their current Tauranga premises and will move to new offices in the CBD next year, marking the next phase in the firm’s success. Dean Thompson adds, “we have always got room for good people.”

Please reach out to Hilary for any property or commercial enquiries hilary.anderson@hobec.co.nz or 07 571 3836.